This is a sponsored campaign with Mom It Forward Influencer Network. #ChaseSlate

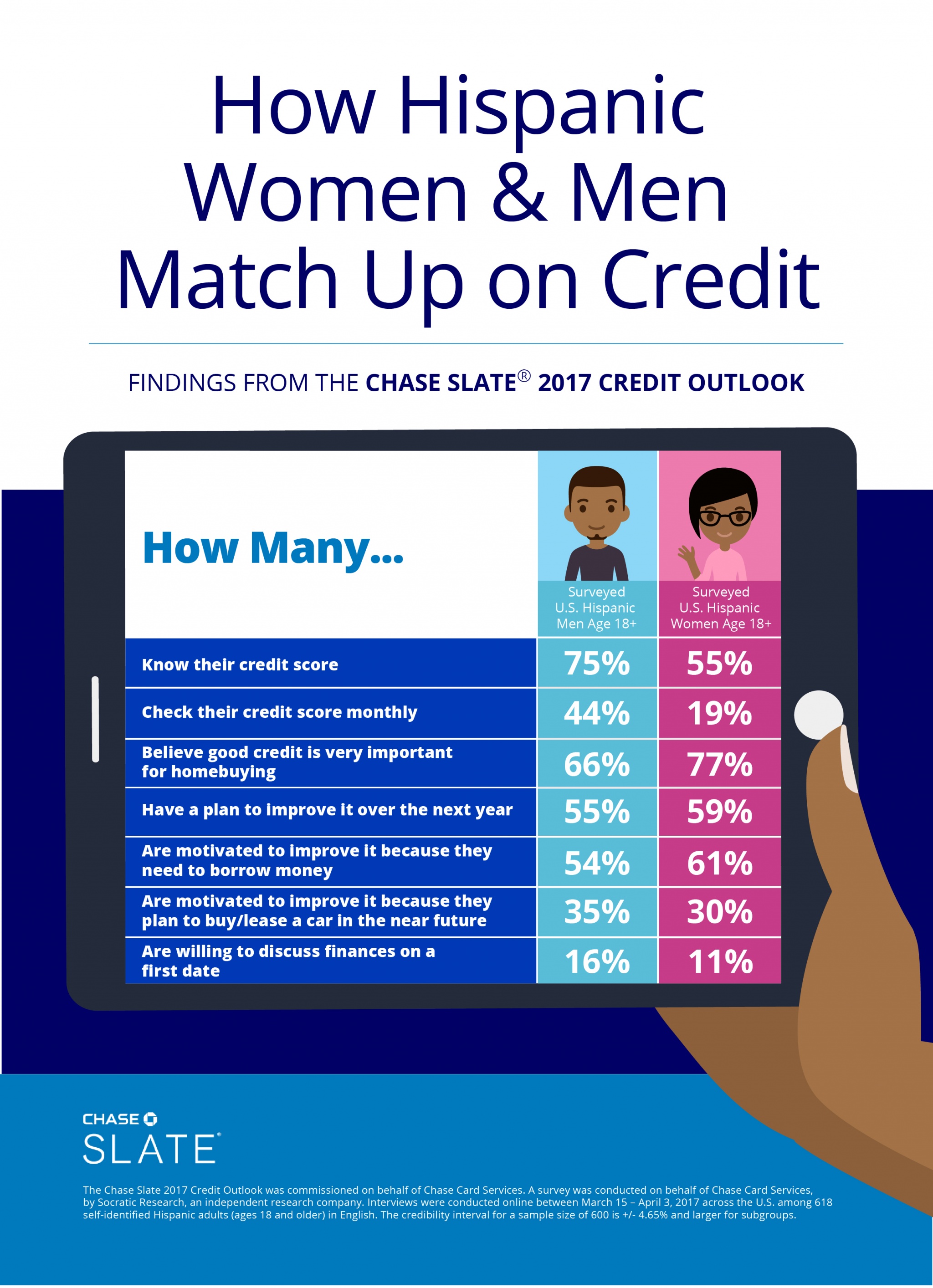

When I moved to the United States with my family nine years ago from Guatemala I didn’t have credit history. I have slowly been building up my credit and improving it and to accomplish that it’s very important for me to stay on top of my credit score and learn about ways in which I can increase it. According to a Chase Slate 2017 Outlook Survey I am not alone as the results prove that while fewer U.S. Hispanics are satisfied with their credit score compared to all adults, they appear to be more motivated to improve their score in the next year, with many more having a plan than adults nationally.

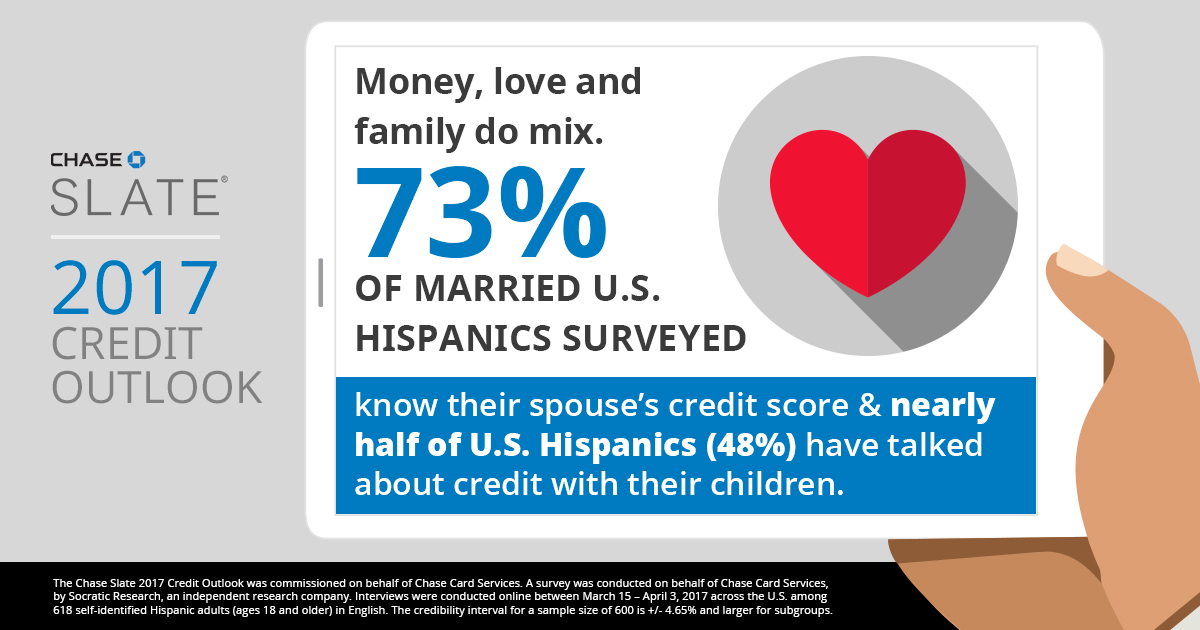

It has taken me many years to build up my credit score and credit history as I had to start from scratch. This was the case for many things, not only my credit, when I immigrated to the United States. For our family it was very important to build that credit history so that we could fully live the American dream. To accomplish this my husband and I have had to work together and set up a plan where we checked our score regularly and take the steps we needed to improve it. It seems that like us, many Hispanic couples work together when it comes to their credit score. Key findings of the survey also showed that money and love do mix. In relationships, most Hispanics believe that having credit transparency in the couple is important.

As our kids get older and my daughter starts middle school this year we have already started to have conversations with them about the importance to build a good credit score, to live below their means so that they can save. For kids it’s sometimes hard to understand where money comes from and how we pay for things when everything is charged to a credit or debit card. That is why it’s so important for them to understand what credit is and how to use it wisely.

Chase Slate’s 2017 Credit Outlook Survey highlights that U.S. Hispanic are optimistic about improving their credit score in 2017. I would have to agree as my husband and I are both optimistic and believe that we will be able to improve our credit score this year. We are off to an amazing start this year as just last month I paid off the last of my credit card debt!

Are you trying to improve your credit score in 2017?

- Guatemalan Dulce de Chilacayote Recipe (Crystalized Chilacayote Candy) - February 26, 2024

- Guatemalan Naranjas en Miel Recipe (Candied Oranges Recipe) - February 25, 2024

- Traditional Guatemalan Candy - February 25, 2024

wow! how interesting is that? i almost have a similar experience as a new immigrant to canada! i wonder if it is an immigrant thing! http://www.crayonized.com

I am hoping to get my credit score up soon. We have quite a bit of debt at the moment but are working on paying it all off.

It’s so funny. I talked about credit in my post this week as well. It’s very important to protect your credit profile and be financially responsible.

I’m always watching my credit score and making sure it’s the best it can be. I love that you are already teaching your middle school aged daughter about credit scores. She’ll be much better prepared for her future.

Always been grateful that our credit score has always been high. For some people it is hard once they have bad credit to get it back.

Wow. I didn’t know that. I think we all can use to save a bit and all use to improve our credit scores.

I am working on improving my credit score and teaching my children the value of good credit. Our church even offers a Credit Worthiness class to help parishioners become more financially educated.

This is an interesting piece. I have to agree that maintaining proper credit is essential to the American dream. without it you will pay double and triple for the same things.

I bank with Chase and I like them a lot for customer service. Improving my credit score is something I put on the back burner but need to take care of.

My credit score is good but I haven’t had credit in a long time, so that hurts it. It is crazy that you have to use credit to be worthy of a credit card. My parents never have had credit cards, and now that they need them to book hotel rooms or whatever, it’s harder to get them.

This is a really interesting post, it is definitely a must to work on your credit score and try and keep it in good standing as you never know when you might be in need.

A credit score is so important for so many different things. I wish the school curriculum would teach kids more about financial basics and financial responsibility.

I think this is an especially helpful piece. My son-in-law is a Spanish interpreter in our area and he has people asking about credit all the time. I plan on sharing this with him.

This year I have been able to reduce my debt and improve my credit score however its not perfect yet but is getting there. It is truly important to teach children the importance of a good credit rating.

Thankfully (I say thankfully now because it taught me a lot) I had to pay off a lot of debt and build my credit back up early in college. Valuable lesson learned, for sure!

It’s really important to have a good credit score as it can help you land loans faster at better rates. We should really make it a point to keep a good credit record.

From what I have heard from others who have lived outside of the USA credit scores and credit, in general, are far different here than from a lot of other places. I imagine you did have to start from scratch! It isn’t easy but I am so happy that you have worked hard as a couple and achieved!

It can be such a slow process building up your credit. I have been slowly building mine up for what seems like forever!

This is such an important topic and something a lot of people don’t think about or even know about. It’s good to see that Hispanics are working hard on it and that way the next generation will be even more fortunate!

Preparing kids for the future is so smart! Credit is involved in almost every aspect of life these days.

We take good care of our credit standing. I mean, we are not up for any major piurchase (like a new home) but it is always good that our finances are in order. Difficult task, but definitely manageable.

So glad you are talking to your children already about their credit. I would have loved my family to do the same for me. We are lucky now, our kids are starting to getting classes in school to teach them how to manage their credit and finances.

This is a very informative post. Like someone mentioned, I wonder if there is an immigration aspect. As an immigrant, I remember my parents telling me not to get credit cards because of fears that I might be able to use it wisely. Their tactics worked… partially. I went behind their backs and got a credit card AND I proved to them that I had discipline so I used it wisely. I was able to build up my score while in college and still continue to do so.